Chapter 11 From Barter to Money Revision Notes Class 7 Social Science NCERT

NCERT Notes of From Barter to Money for Class 7 SST is available on this page of studyrankers website. This chapter is from NCERT Textbook for Class 7 Social Science named Exploring Society: India and Beyond Part I. This textbook is published by NCERT (National Council of Educational Research and Training). Class 7 Social Science Textbook published by NCERT is prescribed for CBSE students. Chapter 11 From Barter to Money Revision Notes is very helpful in understanding the chapter clearly and in easy manner. Students can also find NCERT Solutions for From Barter to Money on this website for their reference. It is very helpful for class 7 students in preparing for the examination. We have covered all the important points and topics of the From Barter to Money chapter of class 7 SST ncert textbook. Students can also find all the questions answers of From Barter to Money chapter which is in the textbook updated to latest pattern of cbse and ncert.

NCERT Notes for Chapter 11 From Barter to Money Class 7 Social Science

Before the invention of money, people used the barter system to exchange goods and services. For example, crops or beads were traded for other items. The barter system was the earliest form of trade, using items like:

- Cowrie shells

- Salt

- Cloth

- Cattle

However, this system was inefficient.

- Money evolved as a common tool that everyone accepts for buying or selling goods and services, making trade much easier.

- Today, we use coins, notes, and digital methods (like mobile payments) to conduct transactions.

- John Maynard Keynes, a renowned economist, stated that money connects the present to the future by helping us save and spend later.

Why Do We Need Money?

The barter system had many problems, making money necessary.

For Example: A farmer with an ox needs shoes, a sweater, and medicines but faces these challenges:

|

| Barter System |

- Double coincidence of wants: The farmer must find someone who wants an ox and offers exactly what he needs (shoes, sweater and medicines). This is rare.

- Common standard measure of value: It’s hard to decide how much an ox is worth compared to shoes or medicines, as there’s no agreed value.

- Divisibility: An ox cannot be split into parts for smaller trades, like for a sweater.

- Portability: Carrying an ox or bags of wheat (traded for the ox) to different places is difficult.

- Durability: Wheat rots or gets eaten by rats, so it cannot be stored for long.

These problems made trading slow and complex, so a better system was needed. Money solves these issues by being a common, portable, divisible, and durable way to trade.

Modern barter examples still exist, like:

- Junbeel Mela in Assam, where people trade roots, vegetables, and handmade goods for rice cakes and food.

- Book exchanges, where people swap old books for new ones.

- Trading old clothes for new utensils, benefiting both households and vendors.

Basic Functions of Money

Money was invented to make trading easier as the barter system became complex with more goods and longer distances. Money simplifies trade, supports salaries, school fees, and everyday purchases, making life easier than barter.

|

| Main Functions of Money |

Main functions of money:

- Medium of exchange: Money is used to buy and sell goods and services, accepted by everyone, unlike barter’s need for double coincidence.

- Store of value: Money can be saved and used later, unlike wheat that rots. For example, a farmer can keep money from selling an ox for future purchases.

- Common denomination: Money measures the value of goods (prices), making it easy to compare items, like books or shoes.

- Standard of deferred payment: Money allows payments to be made later. For example, if a book costs ₹100 but you have ₹50, you can ask the shopkeeper to accept the rest later.

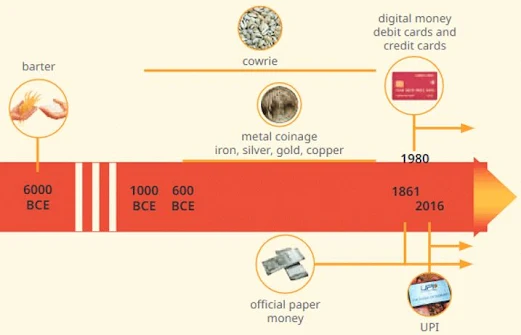

The Journey of Money

Money has changed over time to meet people’s needs.

|

| Journey of Money |

Early forms

- Items like cowrie shells, Rai stones (giant rock discs in Micronesia), Aztec copper Tajadero, and red feather coils (Solomon Islands) were used as money.

Coinage

- Coins were one of the earliest forms of money, issued by rulers for transactions in their kingdoms.

- Made from precious metals like gold, silver, or copper alloys, called kārshāpanas or panas in ancient India.

- Had symbols (rupas) like animals, trees, kings, or deities. For example, Chalukya coins had a Varaha (Vishnu avatar) and a parasol; Chola coins had a tiger.

- Powerful rulers’ coins were accepted across kingdoms, boosting trade.

- Roman coins found in Tamil Nadu and Kerala show India’s strong maritime trade with the world, favoring India’s economy.

- Modern coins use iron alloys with chromium, silicon, and carbon, and have Hindi and English text. Special coins mark national events.

- In 1947, 1 anna (1/16 of a rupee) could buy a dozen bananas.

- The ₹ symbol, designed by Udaya Kumar in 2010, combines Devanagari “Ra,” Roman “R,” and two stripes for the national flag.

Paper currency

- Paper money began in China and was introduced in India in the late 18th century by banks like the Bank of Bengal and Bank of Bombay.

- Used for higher denominations (e.g., ₹10, ₹100, ₹500), while coins are for smaller ones (e.g., ₹1, ₹5).

- Modern notes have cultural motifs (e.g., on ₹50 or ₹100 notes) and special features like raised marks for the visually impaired to identify denominations.

- The Reserve Bank of India (RBI) is the only legal authority to issue currency in India, ensuring control and preventing illegal printing.

Digital money

- With technology, money became intangible (cannot be touched), called digital money.

- Example: Krishnappa, a fruit seller, uses a QR code for customers to pay digitally, transferring money to his bank account.

- Other methods include debit cards, credit cards, net banking, and UPI (Unified Payments Interface), moving money directly between bank accounts.

Points to Remember

- The barter system was used before money, trading goods like cowrie shells and cattle.

- Money was developed to overcome barter’s limitations, like double coincidence of wants and lack of durability.

- Money evolved from coins and paper currency to digital forms like UPI and QR codes.

Difficult Words

- Barter System: Exchanging goods or services without using money.

- Money: A common tool accepted for buying or selling goods and services.

- Transaction: A business deal, like buying or selling something.

- Commodities: Items used for trade, like cowrie shells or cattle.

- Double coincidence of wants: When two people each have what the other wants for trade.

- Common standard measure of value: An agreed way to measure the worth of goods.

- Divisibility: The ability to split something into smaller parts for trade.

- Portability: The ease of carrying or moving something.

- Durability: The ability of something to last long without damage.

- Medium of exchange: Something accepted by all for buying and selling.

- Store of value: Something that can be saved and used later.

- Common denomination: A way to measure and compare the value of goods.

- Standard of deferred payment: Using money to pay for something later.

- Coinage: Coins used as money, often made by rulers.

- Currency: The money system of a country, like rupees in India.

- Denominations: Different units of money, like ₹1 or ₹100.

- Obverse: The front side of a coin with the main design.

- Digital money: Money in electronic form, not physical coins or notes.

- QR Code: A pattern of squares scanned by phones for digital payments.