NCERT Solutions for Class 11th: Ch 3 Recording of Transactions - I (Analysis of Transactions) Accountancy

Numerical Question

Analysis of Transactions

1. Prepare accounting equation on the basis of the following:

Answer

Page No: 81

2. Prepare accounting equation from the following:

Answer

3. Mohit has the following transactions, prepare accounting equation:

Answer

4. Rohit has the following transactions

Prepare the Accounting Equation to show the effect of the above transactions on the assets, liabilities and capital.

Answer

5. Use accounting equation to show the effect of the following transactions of M/s Royal Traders:

Answer

6. Show the accounting equation on the basis of the following transaction:

Analysis of Transactions

1. Prepare accounting equation on the basis of the following:

| (a) | Harsha started business with cash | Rs 2,00,000 |

| (b) | Purchased goods from Naman for cash | Rs 40,000 |

| (c) | Sold goods to Bhanu costing Rs 10,000/- | Rs 12,000 |

| (d) | Bought furniture on credit | Rs 7,000 |

Answer

Page No: 81

2. Prepare accounting equation from the following:

| (a) | Kunal started business with cash | Rs.2,50000 |

| (b) | He purchased furniture for cash | Rs. 35,000 |

| (c) | He paid commission | Rs. 2,000 |

| (d) | He purchases goods on credit | Rs. 40,000 |

| (e) | He sold goods (Costing Rs.20,000) for cash | Rs. 26,000 |

Answer

3. Mohit has the following transactions, prepare accounting equation:

| (a) | Business started with cash | Rs. 1,75,000 |

| (b) | Purchased goods from Rohit | Rs. 50,000 |

| (c) | Sales goods on credit to Manish (Costing Rs. 17,500) | Rs. 20,000 |

| (d) | Purchased furniture for office use | Rs. 10,000 |

| (e) | Cash paid to Rohit in full settlement | Rs. 48,500 |

| (f) | Cash received from Manish | Rs. 20,000 |

| (g) | Rent paid | Rs. 1,000 |

| (h) | Cash withdrew for personal use | Rs. 3,000 |

Answer

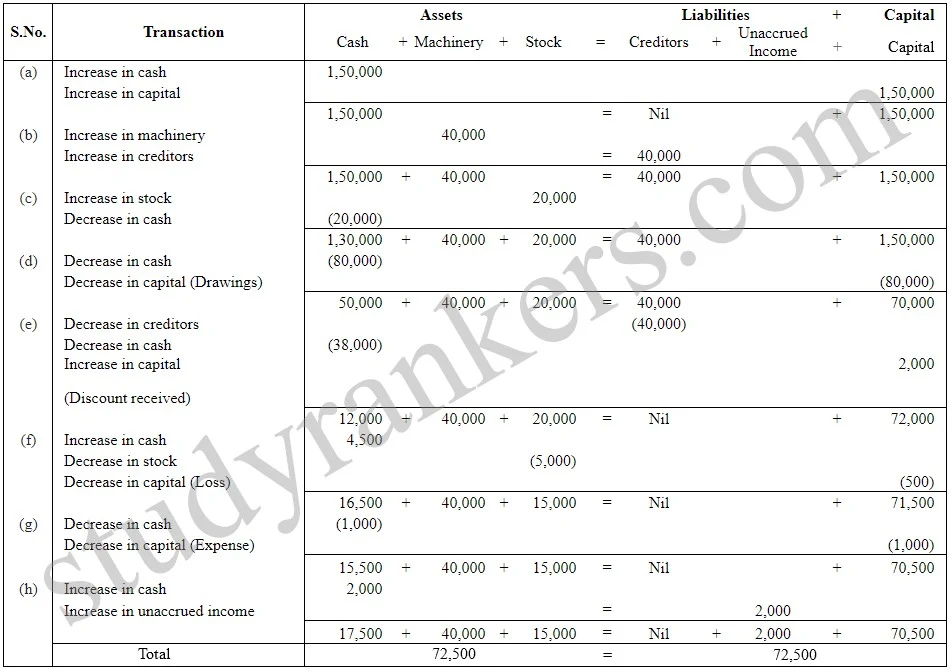

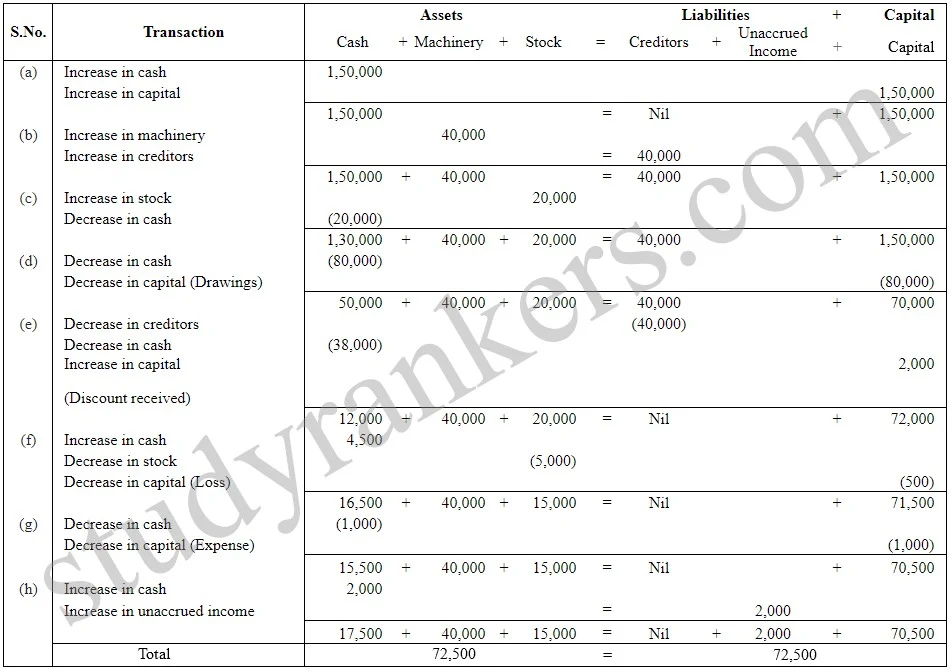

4. Rohit has the following transactions

| (a) Commenced business with cash |

Rs.1,50,000

|

| (b) Purchased machinery on credit |

Rs. 40,000

|

| (c) Purchased goods for cash |

Rs. 20,000

|

| (d) Purchased car for personal use |

Rs. 80,000

|

| (e) Paid to creditors in full settlement |

Rs. 38,000

|

| (f) Sold goods for cash costing Rs. 5,000 |

Rs. 4,500

|

| (g) Paid rent |

Rs. 1,000

|

| (h) Commission received in advance |

Rs. 2,000

|

Prepare the Accounting Equation to show the effect of the above transactions on the assets, liabilities and capital.

Answer

5. Use accounting equation to show the effect of the following transactions of M/s Royal Traders:

| (a) Started business with cash |

Rs.1,20,000

|

| (b) Purchased goods for cash |

Rs. 10,000

|

| (c) Rent received |

Rs. 5,000

|

| (d) Salary outstanding |

Rs. 2,000

|

| (e) Prepaid Insurance |

Rs. 1,000

|

| (f) Received interest |

Rs. 700

|

| (g) Sold goods for cash (Costing Rs. 5,000) |

Rs. 7,000

|

| (h) Goods destroyed by fire |

Rs. 500

|

Answer

6. Show the accounting equation on the basis of the following transaction:

| (a) Udit started business with: (i) Cash (ii) Goods |

Rs. 5,00,000 Rs. 1,00,000 |

| (b) Purchased building for cash |

Rs. 2, 00,000

|

| (c) Purchased goods from Himani |

Rs. 50,000

|

| (d) Sold goods to Ashu (Cost Rs. 25,000) |

Rs. 36, 000

|

| (e) Paid insurance premium |

Rs. 3,000

|

| (f) Rent outstanding |

Rs. 5,000

|

| (g) Depreciation on building |

Rs. 8,000

|

| (h) Cash withdrawn for personal use |

Rs. 20,000

|

| (i) Rent received in advance |

Rs. 5,000

|

| (j) Cash paid to himani on account |

Rs. 20,000

|

| (k) Cash received from Ashu |

Rs. 30,000

|

Answer

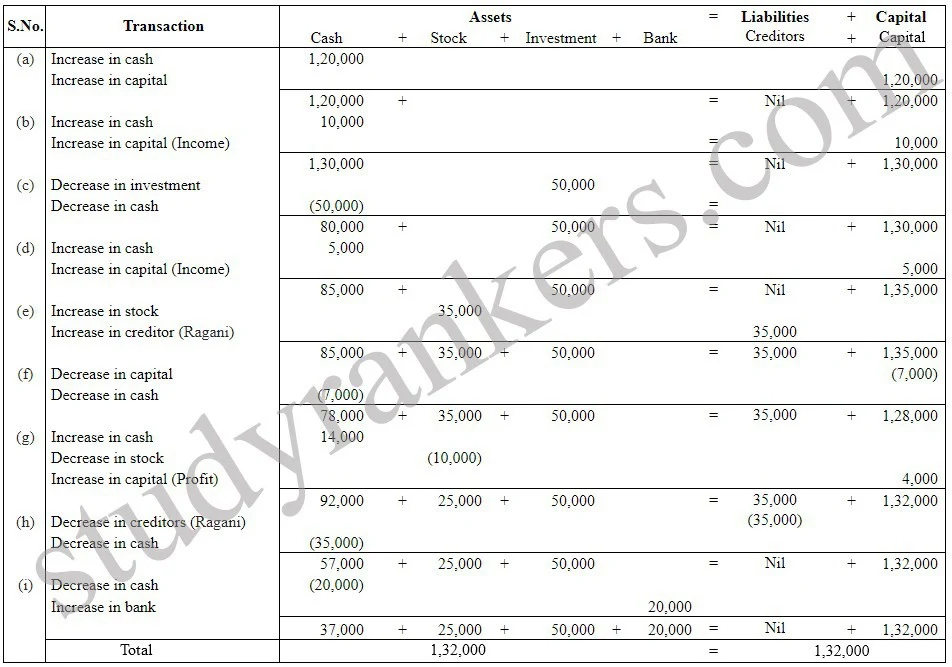

7. Show the effect of the following transactions on Assets, Liabilities and Capital through accounting equation:

| (a) Started business with cash |

Rs. 1,20,000

|

| (b) Rent received |

Rs. 10,000

|

| (c) Invested in shares |

Rs. 50,000

|

| (d) Received dividend |

Rs. 5,000

|

| (e) Purchase goods on credit from Ragani |

Rs. 35,000

|

| (f) Paid cash for house hold Expenses |

Rs. 7,000

|

| (g) Sold goods for cash (costing Rs.10,000) |

Rs. 14,000

|

| (h) Cash paid to Ragani |

Rs. 35,000

|

| (i) Deposited into bank |

Rs. 20,000

|

Answer

8. Show the effect of following transaction on the accounting equation:

| (a) Manoj started business with (i) Cash (ii) Goods (iii) Building |

Rs. 2,30,000 Rs. 1,00,000 Rs. 2,00,000 |

| (b) He purchased goods for cash |

Rs. 50,000

|

| (c) He sold goods(costing Rs.20,000) |

Rs. 35,000

|

| (d) He purchased goods from Rahul |

Rs. 55,000

|

| (e) He sold goods to Varun (Costing Rs. 52,000) |

Rs. 60,000

|

| (f) He paid cash to Rahul in full settlement |

Rs. 53,000

|

| (g) Salary paid by him |

Rs. 20,000

|

| (h) Received cash from Varun in full settlement |

Rs. 59,000

|

| (i) Rent outstanding |

Rs. 3,000

|

| (j) Prepaid Insurance |

Rs. 2,000

|

| (k) Commission received by him |

Rs. 13, 000

|

| (l) Amount withdrawn by him for personal use |

Rs. 20,000

|

| (m) Depreciation charge on building |

Rs. 10,000

|

| (n) Fresh capital invested |

Rs. 50,000

|

| (o) Purchased goods from Rakhi |

Rs. 6,000

|

Answer

9. Transactions of M/s Vipin Traders are given below.

Show the effects on Assets, Liabilities and Capital with the help of accounting Equation.

| (a) Business started with cash |

Rs. 1,25,000

|

| (b) Purchased goods for cash |

Rs. 50,000

|

| (c) Purchase furniture from R.K. Furniture |

Rs. 10,000

|

| (d) Sold goods to Parul Traders (Costing Rs. 7,000 vide bill no. 5674) |

Rs.9,000

|

| (e) Paid cartage |

Rs. 100

|

| (f) Cash Paid to R.K. furniture in full settlement |

Rs. 9,700

|

| (g) Cash sales (costing Rs.10,000) |

Rs. 12,000

|

| (h) Rent received |

Rs. 4,000

|

| (i) Cash withdrew for personal use |

Rs. 3,000

|

Answer

10. Bobby opened a consulting firm and completed these transactions during November, 2014:

(a) Invested Rs. 4,00,000 cash and office equipment with Rs. 1,50,000 in a business called Bobbie Consulting.

(b) Purchased land and a small office building. The land was worth Rs. 1,50,000 and the building worth Rs. 3, 50,000. The purchase price was price was paid with Rs. 2,00,000 cash and a long term note payable for Rs. 8,00,000.

(c) Purchased office supplies on credit for Rs. 12,000.

(d) Bobbie transferred title of motor car to the business. The motor car was worth Rs. 90,000.

(e) Purchased for Rs. 30,000 additional office equipment on credit.

(f) Paid Rs. 75,00 salary to the office manager.

(g) Provided services to a client and collected Rs. 30,000

(h) Paid Rs. 4,000 for the month’s utilities.

(i) Paid supplier created in transaction c.

(j) Purchase new office equipment by paying Rs. 93,000 cash and trading in old equipment with a recorded cost of Rs. 7,000.

(k) Completed services of a client for Rs. 26,000. This amount is to be paid within 30 days.

(l) Received Rs. 19,000 payment from the client created in transaction k.

(m) Bobby withdrew Rs. 20,000 from the business.

Analyse the above stated transactions and open the following T-accounts:

Cash, client, office supplies, motor car, building, land, long term payables, capital, withdrawals, salary, expense and utilities expense.

Answer

(a) Analysis of Transaction → The transaction increase cash and office equipment on one hand and increases capital on the other hand. Increase in assets is debited and increase in capital is credited. Hence, the transaction will be recorded with debit the cash and office equipment and credit the capital.

(b) Analysis of Transaction → This transaction increases ( assets ) Land and building on one hand decreases cash and increases outside liabilities on the other on one hand decrease cash and increase outside liabilities on the other hand. Increase in assets are debited and a decrease in assets are credited. On the other side, increase in liabilities will also be credited.

(c) Analysis of Transaction → This transaction increases assets on one hand and increase liabilities on another hand. Increase in assets is debited and increase in liabilities is credited. The office supplies will be debited and creditors will be credited.

(d) Analysis of Transaction → The transaction increases motor car on one hand and increases capital on other hand. Increases in assets is debited and increase in capital is credited. The transaction will be recorded as debit the motor car and credit the increase in capital.

(e) Analysis of Transaction → The transaction increases office equipment assets on one side and creditors as liabilities on another side. Increase in assets is debited and increase in liabilities is credited.

(f) Analysis of Transaction → The Payment of salary is an expense which decreases capital thus, are recorded as debit. Credit cash to record decrease in assets.

(g) Analysis of Transaction → The transaction will increase assets cash on one side and increase revenue on the other side . Increase in assets cash will be debited and for increase in revenue Service account will be credited.

(h) Analysis of Transaction → The Payment of month's liabilities is an expense which decreases capital and recorded as debit and record cash as credit to record decrease in assets.

(i) Analysis of Transaction → This transaction decreases the assets and also decreases the liabilities. Record decrease in assests case will be credited and decrease in liabilities Creditor's account will be debited.

(j) Analysis of Transaction → In this transaction, one assets office equipment is increasing and decreasing. The increased cost of equipment will be recorded as debit and decreased cost of equipment is recorded as credit. On the other hand , difference amount paid by cash will be decrease the assets and recorded in credit side

(k) Analysis of Transaction → This transaction increases assets on one side and increases in capital on the other side. Increase in assets Client account will be debited and to record increase in capital Service account will be credited.

(l) Analysis of Transaction → In this transaction , one assets cash in increasing and recorded as debit and another assets client is decreasing recorded as credit.

(m) Analysis of Transaction → In this transaction, assets is decreasing one side cash will be credited to record the transaction and capital on the other side is decreasing will be recorded as debit side.

NCERT Solutions of Ch 3 Recording of Transactions - I (Theory)

NCERT Solutions of Ch 3 Recording of Transactions - I (Journalising)

Go To Chapters